It seems like VRTX is the subject of the majority of my articles (link one, two, three to past articles) and for good reasons. VRTX is looking to become one of the rare success stories in a very tough industry by launching a product with huge commercial potential against Hepatitis-C Virus which currently does not have great treatment and is a large epidemic problem.

The chart to the right shows the recent

resistance created at $45.00 which coincided with the release of interim safety updates from Phase II trials of Telaprivir.

Of patients who received the drug in clinical trials, 9% discontinued treatment due to side effects such as rash, gastrointestinal disorders and anemia, and 3% stopped treatment due to side effects that were considered serious. After 12 weeks, 65 out of 74 patients had undetectable levels of the virus, Vertex says. It should be pointed out that these patients are also taking the standard treatment of Ribavirin and Peg-Interferon (Placebo) which already have a bad side effect profile. The key is to compare the Telaprivir arm of the trial to the Placebo. From what I read, the number of patients in the Placebo arm are significantly less than the drug arm and therefore any safety assessments are premature. However, serious adverse effects in the Telaprivir patients that do not exist in the Placebo should be cause for concern. So far, I don't see any major and frequent side effects that would stop this drug from reaching the market. At the end, the overwhelming ( 88% )undetectable responders should be enough to advance this drug to the clinic unless some very serious unforeseen side effects show up in a larger study.

The news of advancement of the Aurora kinase inhibitor (really a multi kinase inhibitor) into phase II leukemia trials and receipt of a $25 million payment is a positive news but not one to move the stock significantly. I do not know the licensing arrangement between Merck and Vertex but I expect Vertex will receive about 10-20% of revenues plus upfront milestone payments. Overall, I think this product is worth about 200-500 million in market cap value which will not all be realized until the drug enters the market.

Also, the news of GSK dropping the HIV inhibitor partnership should not be cause for concern because Vertex is losing a few million in milestone payments and about 10% ( based on past HIV drug royalties) in sales at launch.

Bottom line:

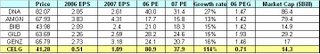

The recent imperfect clinical updates have resulted in a pause of the rapid share price gains seen in 2006. The recent and forthcoming milestone payments should help with the cash flows and upside earning/share anouncements in 2007. I believe the stock is failry valued between 4-5 billion and any moves below this range, unrelated to the clinical data, should be purchased. For aggressive traders, selling $45 calls and $30 puts could add some additional cash to the portfolio. I expect Vertex to trade between $35 and $45 in the next 6 months. I recommend to accumulate shares currently around $37 with a price target of $45 this year. As Telepravir enters Phase III, I expect the stock to trade between 6-10 billion ( compareable to recent biotech companies who have launched successful drugs) the Ultimately, even with great clinical trial results of both efficacy and safety, market lanuch is not going to happen until 2009! I am putting a hold rating on this stock. If you already have some shares there is no need to increase or decrease your position at this point as I expect VRTX to trade in a range in the next few months.

JMHO