Tysabri was first launched in 2005 as a revolutionary treatment for Multiple Sclerosis, an autoimmune disease affecting the central nervous system. Tysabri, a biologic co-developed with Elan (ELN), showed great success in clinical trials. It was really a miracle drug that helped many patients live pain free lives for the first time.

Then there were a few cases of complications and deaths from Tysabri. Although, these cases were rare and occurred in patients with complicated cases often on many different therapies, Biogen-Idec voluntarily took it off of the market to access its safety. A year later, Tysabri is back on the market and many feel that it's image has been tarnished.

I beg to differ. Tysabri meets my blockbuster criteria ( see my other article where I explain my success criteria for biotech companies link). It is truly a novel medication in a disease that has been poorly treated to date and has a huge market size. One of it's negative attributes is that it is a biologic and must be injected in a physician's office. This is actually not a bad trait since it helps minimize mid-dosing problems. There are a few successful injectables on the market such as Enbrel).

I also think the delay has had operational and logistical benefits for Biogen-Idec. The company has had more time to optimize its launch strategy and will be simultaneously launching in Europe. Also, it is not a cheap drug. At about $20K per year it could quickly add to the bottom line.

Yes physicians and patients as well as Biogen-idec employees will be very careful to look for signs of complications, but the positive aspects of this drug is too good and should help overcome these challenges. Another positive is a lack of hype for this drug. I don't believe the upside has been captured here. This very important because most companies with blockbusters have so much anticipation built into them that any slip up will cause the stock to tank.

I expect a modest upside surprise in Tysabri in Q3 but definitely expect an increase in estimates in Q4. Today BIIB closed at $44.6 and trading at about 18.5 times 2007 earnings a very low multiple for this type of stock (link to chart). 2007 is only a few months away and historically these stocks trade at about 30-35X current year. At 14.9 billion in market cap it is a very cheap biotech stock. Biogen-idec has a lot of cash and has been investing heavily to boost it's pipeline. I think BIIB should be accumulated at these levels with intentions of selling in the 60's in 2007. The price increase will be supported by increased earnings as well as increased in PE ratios paid for this company. The chart will not give a strong buy signal until the stock crosses above it's current 200 moving average of about $45. But I am a buyer at any level below here.

JMHO

These are my opinions on some stocks that I follow and/or own. They are not to be considered as investment advice. I will try to post as many accurate facts as I can. If you disagree with my opinions or have noticed an error in my statements feel free to send me your comments. Please do not follow my advice unless you are willing to lose money without blaming me or taking legal actions! I encourage you to do your own homework and understand the risks before making any investments.

Wednesday, September 27, 2006

Thursday, September 21, 2006

Vertex (VRTX) has the right formula for success

The recent slump in most Biotech names would make you believe that the industry is in trouble, but this may be a just a great opportunity to buy shares of great companies at a discount. One of the main attractions of this industry is the patentability of their products. The others are pricing power, high profit margins and relative immunity to economic conditions. They are however affected by political events and changes in regulations. But what attracts me the most is the virtual monopolies that some biotech companies enjoy. This virtual monopoly is a result of the extremely difficult challenges facing these innovative companies. There is a good amount of luck that is behind some of the great successful stories like Genentech (DNA), Amgen (AMGN), Biogen-Idec (BIIB) and Genzyme (GENZ). But what they all have in common is that they have a dominant product in a disease area with significant unmet medical need. This is what I look for when I try to find the next successful company. Who is going to come up with the next treatment for a disease that currently does not have a great therapy and also is coupled with a large enough market? This link to the Motleyfool.com also provides a great set of rules for investing in Biotechnology stocks.

Vertex Pharmaceutical (VRTX) has this success formula in their late stage product VX950 for treatment of Hepatitis-C. It has all the characteristics of a blockbuster that could propel Vertex into the category of a great biotech company.

First the market; Hepatitis-C is a devastating infectious blood born disease that could get transmitted by blood or sexual contact. It can survive outside the human host for up to a week and was not discovered until early 90's. Some think the whole US blood supply was contaminated with this virus in the 80's since there was not testing done yet. What makes this virus more dangerous is the fact that it has a dormant period of up to two decades. This means that we may have not even begun to see this epidemic yet. It is estimated that about 4 million people in the United States are infected with hepatitis C, which is about 2% of the population. The number of patients with chronic Hepatitis-C is expected to increase to 10.8 million in the next 10 to 12 years. Each year, there are about 35,000 cases of acute hepatitis C.

The treatment is difficult since by the time most people have found out they have Hep-C, their liver is severely damaged. The standard therapy is Pegylated-Interferon alpha, a protein that non-specifically increases the immune response and Ribavirin an antiviral. Unfortunately, this combination is not very effective. Last time I checked, the response rate was around 50%. Furthermore, the side effects are almost impossible to handle. I personally know someone who took these medications and he complained of having bad flu like symptoms every day for a year. This treatment is so bad that most people can not finish the 12 month duration and some become suicidal.

VX950 has shown tremendous efficacy with minimal side effects in early clinical trials. A phase Ib trial showed most patients responding very after a couple of weeks of treatment and in some cases the virus was completely gone which lead to the FDA granting fast track status. What makes VX950 special and hard to copy is that Vertex was a pioneer in this field. They were the first company to solve the 3D crystal structure of the protease protein that VX950 inhibits (they also did the same for HIV protease which revolutionized treatment of HIV). I don't want to get into the science but solving this structure and finding a molecule to specifically inhibit it that is safe and gets absorbed by the body is next to impossible. They have a huge head start and have solved some incredible problems. Even if someone wants to imitate this molecule, its chemical structure is so complicated that it makes manufacturing process development very difficult. VX950 is a direct result of huge perseverance by Vertex scientists and management mixed with some good luck.

Because of all these reasons, I believe VX950 will make it to the market and will be a multi billion dollar product with limited competition for a long time. The product is not expected to launch until late2008 (aggressive timeline) but at $3.5 billion market cap it has lots of upside movements left as this product moves through clinical trials. I expect Vertex's market cap to be around 7-10 billion right around the launch time and I will be aggressively buying dips from now until then. In addition to VX950, the company has products in trials to treat inflammatory diseases such as a p38 inhibitor which could be the first oral RA medication. They have a partnership with Merck to develop a kinase inhibitor for treating cancer and they have the first and second ever compounds in clinic to treat Cystic Fibrosis. Vertex should be admired for its science and should be a core holding in the biotech portion of any portfolio.

As of the posting date of this blog, Vertex is trading at $33.25 and should be accumula ted aggressively. It has been consolidating since making its high of about $44 for a 25% correction and has found support at $30.

ted aggressively. It has been consolidating since making its high of about $44 for a 25% correction and has found support at $30.

During this time, VRTX has made a partnership with J&J for distribution of VX950 outside US worth about $545 million while keeping sales in US. They have also raised $300 million in a public offering and have retired some convertible debt. These activities should provide enough cash for VRTX to get this product to the market and become a success story.

JMHO

Vertex Pharmaceutical (VRTX) has this success formula in their late stage product VX950 for treatment of Hepatitis-C. It has all the characteristics of a blockbuster that could propel Vertex into the category of a great biotech company.

First the market; Hepatitis-C is a devastating infectious blood born disease that could get transmitted by blood or sexual contact. It can survive outside the human host for up to a week and was not discovered until early 90's. Some think the whole US blood supply was contaminated with this virus in the 80's since there was not testing done yet. What makes this virus more dangerous is the fact that it has a dormant period of up to two decades. This means that we may have not even begun to see this epidemic yet. It is estimated that about 4 million people in the United States are infected with hepatitis C, which is about 2% of the population. The number of patients with chronic Hepatitis-C is expected to increase to 10.8 million in the next 10 to 12 years. Each year, there are about 35,000 cases of acute hepatitis C.

The treatment is difficult since by the time most people have found out they have Hep-C, their liver is severely damaged. The standard therapy is Pegylated-Interferon alpha, a protein that non-specifically increases the immune response and Ribavirin an antiviral. Unfortunately, this combination is not very effective. Last time I checked, the response rate was around 50%. Furthermore, the side effects are almost impossible to handle. I personally know someone who took these medications and he complained of having bad flu like symptoms every day for a year. This treatment is so bad that most people can not finish the 12 month duration and some become suicidal.

VX950 has shown tremendous efficacy with minimal side effects in early clinical trials. A phase Ib trial showed most patients responding very after a couple of weeks of treatment and in some cases the virus was completely gone which lead to the FDA granting fast track status. What makes VX950 special and hard to copy is that Vertex was a pioneer in this field. They were the first company to solve the 3D crystal structure of the protease protein that VX950 inhibits (they also did the same for HIV protease which revolutionized treatment of HIV). I don't want to get into the science but solving this structure and finding a molecule to specifically inhibit it that is safe and gets absorbed by the body is next to impossible. They have a huge head start and have solved some incredible problems. Even if someone wants to imitate this molecule, its chemical structure is so complicated that it makes manufacturing process development very difficult. VX950 is a direct result of huge perseverance by Vertex scientists and management mixed with some good luck.

Because of all these reasons, I believe VX950 will make it to the market and will be a multi billion dollar product with limited competition for a long time. The product is not expected to launch until late2008 (aggressive timeline) but at $3.5 billion market cap it has lots of upside movements left as this product moves through clinical trials. I expect Vertex's market cap to be around 7-10 billion right around the launch time and I will be aggressively buying dips from now until then. In addition to VX950, the company has products in trials to treat inflammatory diseases such as a p38 inhibitor which could be the first oral RA medication. They have a partnership with Merck to develop a kinase inhibitor for treating cancer and they have the first and second ever compounds in clinic to treat Cystic Fibrosis. Vertex should be admired for its science and should be a core holding in the biotech portion of any portfolio.

As of the posting date of this blog, Vertex is trading at $33.25 and should be accumula

ted aggressively. It has been consolidating since making its high of about $44 for a 25% correction and has found support at $30.

ted aggressively. It has been consolidating since making its high of about $44 for a 25% correction and has found support at $30.During this time, VRTX has made a partnership with J&J for distribution of VX950 outside US worth about $545 million while keeping sales in US. They have also raised $300 million in a public offering and have retired some convertible debt. These activities should provide enough cash for VRTX to get this product to the market and become a success story.

JMHO

Wednesday, September 13, 2006

Know your Biotech Index

Find the right Biotech Index

They say that sector movement accounts for about 50% of a stock’s increase or decrease. Thus, in addition to performing fundamental and technical analysis on a stock one should also take a look at the overall sector. Usually, this task is accomplished by looking at an index of stocks that are in the same business. In addition to sectors and industries some indices also consider the size of the stocks (the Russell 2000 is a small cap index whereas S&P 500 is comprised of large cap stocks).

The two most well known biotech indices are BTK (Amex Bioteck Index) and NBI ( Nasdaq Biotech Index). In addition to these two I also look at BBH, Merrill lynch biotech HOLDERS which is a tradable basket of biotech stocks. Today, I looked at each one of their performances year-to-date and I was quite amazed at the differences between the three.

The following link shows a Year-to-date chart of the above mentioned indices. Overlay chart

Although the direction of the moves of each index tracks with others, the magnitude and recent divergence has made me want to look more closely at them. Since January, BTK is down about 3% while NBI and BBH are down 6% and 13% respectively. Furthermore, in the last week BTK and NBI have been moving up while BBH has been trending downward. Personally, I have been using the BTK to assess the sector movement of my biotech stocks and after seeing this difference, I was not sure if I was using the correct index.

BTK

The BTK (Amex Biotechnology Index) is an equally weighted index of the following stocks:

AFFX, AMGN, BIIB, CELG, CEPH, CRA, DNA, GENZ, GILD, HGSI, ICOS, IMCL, ITMN, IVGN, MEDI, MLNM, MYOG, NKTR, PDLI, VRTX

They all have about a 5% weighing which gets reset every quarter. This is a drawback as it puts equal weight in smaller companies and a few bad performers could have a large impact on the performance of the index. Another drawback of this index is its narrow focus. There are only 20 companies represented (There where 17 in 2004). This list also includes companies that are not drug companies. These include AFFX, CRA, IVGN which sell products or services to the biotech industry. They sell either instruments, technology or raw materials and tend to have lower profit margins, lower growth potential as well as significant amount of competition. IVGN (Invitrogen) for example has been a flat stock since 2000. In my opinion these companies should not be placed in an index of biotech drug manufacturers. Instead, I would like to include ALKS, AMLN, SEPR, CBST, OSIP, RNAI, ALNY or any other biotech company that is trying to market pharmaceutical products which are usually patent protected and have very high profit margins and outstanding market potential.

I do like the fact that the BTK is not weighted by the size of the companies and not dominated by DNA and AMGN.

NBI

The NASDAQ Biotechnology Index (NBI) contains about 170 Nasdaq listed biotechnology and pharmaceutical companies and is calculated using a modified capitalization-weighted methodology. The capitalization weighing however could be counteracted by the number of companies present in this index. This link shows the companies that make up the NBI.

BBH (click on the image to see a list of the stocks in BBH)

The Merrill Lynch Bitoech HOLDERS is a basket of stocks. When you buy a share of BBH, you own a piece of each of the companies. As you can see from this table, this basket is heavily weighted to the large cap compankies such as DNA, AMGN, GILD and GENZ. Interestingly, MLNM (which I think is one of the worse companies in this sector and I will be sure to write a blog entry about it) has a relatively high share. No sign of VRTX, AMLN, PDLI,CEPH or RNAI. This is probably the weakest of the three indices because it has a limited number of company and it is biased towards large cap stocks.

The Merrill Lynch Bitoech HOLDERS is a basket of stocks. When you buy a share of BBH, you own a piece of each of the companies. As you can see from this table, this basket is heavily weighted to the large cap compankies such as DNA, AMGN, GILD and GENZ. Interestingly, MLNM (which I think is one of the worse companies in this sector and I will be sure to write a blog entry about it) has a relatively high share. No sign of VRTX, AMLN, PDLI,CEPH or RNAI. This is probably the weakest of the three indices because it has a limited number of company and it is biased towards large cap stocks.

Bottom Line

After analyzing the three indices, it is my opinion that NBI is the most relevant index unless you own DNA or AMGN then I would use the BBH. BTK has an advantage because it is equal weighted but it does not have enough of relevant biotech stocks to make it a good index. You could make your own basket of relevant equally weighted 50 biotech stocks (all in the same growth stage) that would be better than any of the above indices but who has time for that?

If you want to track the performance of biotech companies that are not large cap such asDNA, AMGN, GENZ, BIIB, you can use the difference between NBI and the BTK. The comparison between BBH and BTK could be used to determine the effect of weighting. BBH, the weighted index of 17 stocks is down 13% YTD while BTK the equally weighted index of similar 20 stocks is down only 3% YTD.

To me this suggest that the large cap biotechs have been hurting the most in this sector. In fact if you look at my CELG article , you can see a table that shows relatively low PE and relatively low expected growth rates for the large cap biotechs. The 2007PEG(PE07/growth ratio) for these stocks is between 1.42-1.93, which makes them fairly valued. Historically, these companies have had higher PEs and PEGs and as sector rotation puts Bitoech back in favor, I expect these stock prices and PEs to increase. Of course, this assumes no changes in the companies’ businesses going forward. As new products are launched or mergers occur, these companies could take off.

JMHO

They say that sector movement accounts for about 50% of a stock’s increase or decrease. Thus, in addition to performing fundamental and technical analysis on a stock one should also take a look at the overall sector. Usually, this task is accomplished by looking at an index of stocks that are in the same business. In addition to sectors and industries some indices also consider the size of the stocks (the Russell 2000 is a small cap index whereas S&P 500 is comprised of large cap stocks).

The two most well known biotech indices are BTK (Amex Bioteck Index) and NBI ( Nasdaq Biotech Index). In addition to these two I also look at BBH, Merrill lynch biotech HOLDERS which is a tradable basket of biotech stocks. Today, I looked at each one of their performances year-to-date and I was quite amazed at the differences between the three.

The following link shows a Year-to-date chart of the above mentioned indices. Overlay chart

Although the direction of the moves of each index tracks with others, the magnitude and recent divergence has made me want to look more closely at them. Since January, BTK is down about 3% while NBI and BBH are down 6% and 13% respectively. Furthermore, in the last week BTK and NBI have been moving up while BBH has been trending downward. Personally, I have been using the BTK to assess the sector movement of my biotech stocks and after seeing this difference, I was not sure if I was using the correct index.

BTK

The BTK (Amex Biotechnology Index) is an equally weighted index of the following stocks:

AFFX, AMGN, BIIB, CELG, CEPH, CRA, DNA, GENZ, GILD, HGSI, ICOS, IMCL, ITMN, IVGN, MEDI, MLNM, MYOG, NKTR, PDLI, VRTX

They all have about a 5% weighing which gets reset every quarter. This is a drawback as it puts equal weight in smaller companies and a few bad performers could have a large impact on the performance of the index. Another drawback of this index is its narrow focus. There are only 20 companies represented (There where 17 in 2004). This list also includes companies that are not drug companies. These include AFFX, CRA, IVGN which sell products or services to the biotech industry. They sell either instruments, technology or raw materials and tend to have lower profit margins, lower growth potential as well as significant amount of competition. IVGN (Invitrogen) for example has been a flat stock since 2000. In my opinion these companies should not be placed in an index of biotech drug manufacturers. Instead, I would like to include ALKS, AMLN, SEPR, CBST, OSIP, RNAI, ALNY or any other biotech company that is trying to market pharmaceutical products which are usually patent protected and have very high profit margins and outstanding market potential.

I do like the fact that the BTK is not weighted by the size of the companies and not dominated by DNA and AMGN.

NBI

The NASDAQ Biotechnology Index (NBI) contains about 170 Nasdaq listed biotechnology and pharmaceutical companies and is calculated using a modified capitalization-weighted methodology. The capitalization weighing however could be counteracted by the number of companies present in this index. This link shows the companies that make up the NBI.

BBH (click on the image to see a list of the stocks in BBH)

The Merrill Lynch Bitoech HOLDERS is a basket of stocks. When you buy a share of BBH, you own a piece of each of the companies. As you can see from this table, this basket is heavily weighted to the large cap compankies such as DNA, AMGN, GILD and GENZ. Interestingly, MLNM (which I think is one of the worse companies in this sector and I will be sure to write a blog entry about it) has a relatively high share. No sign of VRTX, AMLN, PDLI,CEPH or RNAI. This is probably the weakest of the three indices because it has a limited number of company and it is biased towards large cap stocks.

The Merrill Lynch Bitoech HOLDERS is a basket of stocks. When you buy a share of BBH, you own a piece of each of the companies. As you can see from this table, this basket is heavily weighted to the large cap compankies such as DNA, AMGN, GILD and GENZ. Interestingly, MLNM (which I think is one of the worse companies in this sector and I will be sure to write a blog entry about it) has a relatively high share. No sign of VRTX, AMLN, PDLI,CEPH or RNAI. This is probably the weakest of the three indices because it has a limited number of company and it is biased towards large cap stocks.Bottom Line

After analyzing the three indices, it is my opinion that NBI is the most relevant index unless you own DNA or AMGN then I would use the BBH. BTK has an advantage because it is equal weighted but it does not have enough of relevant biotech stocks to make it a good index. You could make your own basket of relevant equally weighted 50 biotech stocks (all in the same growth stage) that would be better than any of the above indices but who has time for that?

If you want to track the performance of biotech companies that are not large cap such asDNA, AMGN, GENZ, BIIB, you can use the difference between NBI and the BTK. The comparison between BBH and BTK could be used to determine the effect of weighting. BBH, the weighted index of 17 stocks is down 13% YTD while BTK the equally weighted index of similar 20 stocks is down only 3% YTD.

To me this suggest that the large cap biotechs have been hurting the most in this sector. In fact if you look at my CELG article , you can see a table that shows relatively low PE and relatively low expected growth rates for the large cap biotechs. The 2007PEG(PE07/growth ratio) for these stocks is between 1.42-1.93, which makes them fairly valued. Historically, these companies have had higher PEs and PEGs and as sector rotation puts Bitoech back in favor, I expect these stock prices and PEs to increase. Of course, this assumes no changes in the companies’ businesses going forward. As new products are launched or mergers occur, these companies could take off.

JMHO

CELG still has upside potential

CELG is one of the few profitable biotech companies in the middle of a growth phase. I first discovered this growth stock in March of 2005. Since then the stock has more than doubled and split once. In this article, I will present some arguments why it is an attractive stock to purchase.

Products

CELG's products ranked by revenue are Thalomid(Indications: Multiple Myeloma,ENL), Revlimid(Multiple Myeloma, MDS), Alkeran(Multiple Myeloma and Focalin(ADHD). Revlimid

and Tholomid are from the same class of immunomodulary drug(IMiD). Revlimid is the newer generation with a better drug profile (better potency and toxicity).

Most recent Revenue and Earnings

Here are the sales numbers for CELG's major products for the last three quarters ( in million dollars)

Obviously, growth for CELG has been driven by Revlimid. In addition to sales in MDS, Revlimid has been cannibalizing Thalomid sales in Multiple Myeloma. Since CELG pays 1% in royalties for Revlimid compared to 10% for Thalomid, the cannibalization is actually boosting the profit margins of CELG. Another concern is the RevAssist program. Since Revlimid is a new product, the company is providing free samples to new patients and patients that have received this product during a clinical trial. According to the management, this represents 20-25% of the prescriptions. This may be a short term concern for revenues but in the long term it will allow more patients to try Revlimid and become paying customers. This practice is very common in the pharmaceutical industry. During the conference call, the management expects this percentage to drop closer to the industry average of 3-5%.

In addition, last quarter saw a decline in Alkeran. In the conference call, the management addressed this as issues with reimbursement and in manufacturing. They think the sales for Alkeran will recover but they want to be conservative about it.

Stock movement

After a seemingly unstoppable run that started last year and saw the stock price more than double, CELG has been off of it's all time high of about $49 back in July to as low as $41. Part of this is attributable to inflation and recession fears in the market. This profit taking is normal and has coincided with the summer months that historically see low volumes and high volatility.

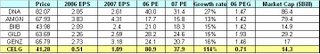

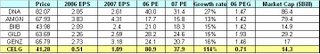

At $41 it is trading at about 80X 2006 earnings (0.51/share estimated) and 38X 2007 earnings (1.09/share estimated). This transaltes to a PEG of about 0.7 (using current PE of 80). To put this in perspective, I have made a table of the same data for other large cap biotech stocks:

Click on the image to enlarge.

These data suggest that CELG is the most expensive stock in that group according to 80 PE but has the highest growth rate at 114%. In fact, if you combine the PE and growth rates in form of PEG, it has the best value with a PEG of 0.71 in this group.

Other factors to consider

CELG is applying for approval of Revlimid in Europe. if approved, this should add significantly to the expected revenues and earnings. The cost of this expansion into europe is already priced in because the company has announced the costs of regulatory filings and has already put into place sales and distribution channels.

In addition, Revlimid is in clinical trials for treating Chronic Lymphocytic Leukemia(CLL) and aggressive non-Hodgkin's lymphomas (NHL) as well as non-deletion 5Q MDS. These, if successful, can add significant revenues in the coming years.

Bottom line:

CELG enjoys a monopoly in blood related cancers with its successful pipeline of IMiDs. Cannibalization of Thalomid by Revlimid is actually good for CELG as it causes profit margin expansion. Additional approvals in Europe and in other diseases would add significant upside potential to current estimates. Downside risks include changes in reimbursement from government or insurers as well as if Revlimid does not get necessary approvals in above mentioned trials. In the long term, CELG has some interesting small molecule kinase inhibitors and other immunomodulators that could allow it to expand into other therapeutic areas including other immune related diseases such as Psoriasis.

As far as trading CELG. I am waiting for the stock price to reach the 200 MVA which is currently around $37. This does not necessarily mean that I am waiting for the stock to drop. The stock could remain above $40 while the MVA moves up over time. I think the third quarter earnings will not be as disappointing as the last one. At $49 CELG's valuation was getting ahead of its earning. But a good Q3 and announcements regarding EU approval and clinical trial developments could send this stock towrds $50 where I think this stock will end up at the end of this year.

Disclosure: As of Sept 13, I own option positions in CELG. They inclue April 2007 $40 call options priced around $7 partially hedged by October$37.5 put options priced around $1. The stock price was around $40.5 when these positions were opened. The goal is to close these positions if CELG moves towards $50 in the near term for a gain of at least %40, or if there is a sharp decline towards $37.5 with a loss of about 10-20%. This will depend on the timing of the move and other outside factors such as volatility.

JMHO

Products

CELG's products ranked by revenue are Thalomid(Indications: Multiple Myeloma,ENL), Revlimid(Multiple Myeloma, MDS), Alkeran(Multiple Myeloma and Focalin(ADHD). Revlimid

and Tholomid are from the same class of immunomodulary drug(IMiD). Revlimid is the newer generation with a better drug profile (better potency and toxicity).

Most recent Revenue and Earnings

Here are the sales numbers for CELG's major products for the last three quarters ( in million dollars)

| Total | Thalomid | Revlimid | other | |

| Q42005 | 149 | 106 | 3 | 40 |

| Q12006 | 182 | 107 | 32 | 43 |

| Q22006 | 197 | 107 | 63 | 6 |

Obviously, growth for CELG has been driven by Revlimid. In addition to sales in MDS, Revlimid has been cannibalizing Thalomid sales in Multiple Myeloma. Since CELG pays 1% in royalties for Revlimid compared to 10% for Thalomid, the cannibalization is actually boosting the profit margins of CELG. Another concern is the RevAssist program. Since Revlimid is a new product, the company is providing free samples to new patients and patients that have received this product during a clinical trial. According to the management, this represents 20-25% of the prescriptions. This may be a short term concern for revenues but in the long term it will allow more patients to try Revlimid and become paying customers. This practice is very common in the pharmaceutical industry. During the conference call, the management expects this percentage to drop closer to the industry average of 3-5%.

In addition, last quarter saw a decline in Alkeran. In the conference call, the management addressed this as issues with reimbursement and in manufacturing. They think the sales for Alkeran will recover but they want to be conservative about it.

Stock movement

After a seemingly unstoppable run that started last year and saw the stock price more than double, CELG has been off of it's all time high of about $49 back in July to as low as $41. Part of this is attributable to inflation and recession fears in the market. This profit taking is normal and has coincided with the summer months that historically see low volumes and high volatility.

At $41 it is trading at about 80X 2006 earnings (0.51/share estimated) and 38X 2007 earnings (1.09/share estimated). This transaltes to a PEG of about 0.7 (using current PE of 80). To put this in perspective, I have made a table of the same data for other large cap biotech stocks:

Click on the image to enlarge.

These data suggest that CELG is the most expensive stock in that group according to 80 PE but has the highest growth rate at 114%. In fact, if you combine the PE and growth rates in form of PEG, it has the best value with a PEG of 0.71 in this group.

Other factors to consider

CELG is applying for approval of Revlimid in Europe. if approved, this should add significantly to the expected revenues and earnings. The cost of this expansion into europe is already priced in because the company has announced the costs of regulatory filings and has already put into place sales and distribution channels.

In addition, Revlimid is in clinical trials for treating Chronic Lymphocytic Leukemia(CLL) and aggressive non-Hodgkin's lymphomas (NHL) as well as non-deletion 5Q MDS. These, if successful, can add significant revenues in the coming years.

Bottom line:

CELG enjoys a monopoly in blood related cancers with its successful pipeline of IMiDs. Cannibalization of Thalomid by Revlimid is actually good for CELG as it causes profit margin expansion. Additional approvals in Europe and in other diseases would add significant upside potential to current estimates. Downside risks include changes in reimbursement from government or insurers as well as if Revlimid does not get necessary approvals in above mentioned trials. In the long term, CELG has some interesting small molecule kinase inhibitors and other immunomodulators that could allow it to expand into other therapeutic areas including other immune related diseases such as Psoriasis.

As far as trading CELG. I am waiting for the stock price to reach the 200 MVA which is currently around $37. This does not necessarily mean that I am waiting for the stock to drop. The stock could remain above $40 while the MVA moves up over time. I think the third quarter earnings will not be as disappointing as the last one. At $49 CELG's valuation was getting ahead of its earning. But a good Q3 and announcements regarding EU approval and clinical trial developments could send this stock towrds $50 where I think this stock will end up at the end of this year.

Disclosure: As of Sept 13, I own option positions in CELG. They inclue April 2007 $40 call options priced around $7 partially hedged by October$37.5 put options priced around $1. The stock price was around $40.5 when these positions were opened. The goal is to close these positions if CELG moves towards $50 in the near term for a gain of at least %40, or if there is a sharp decline towards $37.5 with a loss of about 10-20%. This will depend on the timing of the move and other outside factors such as volatility.

JMHO

Subscribe to:

Posts (Atom)