Products

CELG's products ranked by revenue are Thalomid(Indications: Multiple Myeloma,ENL), Revlimid(Multiple Myeloma, MDS), Alkeran(Multiple Myeloma and Focalin(ADHD). Revlimid

and Tholomid are from the same class of immunomodulary drug(IMiD). Revlimid is the newer generation with a better drug profile (better potency and toxicity).

Most recent Revenue and Earnings

Here are the sales numbers for CELG's major products for the last three quarters ( in million dollars)

| Total | Thalomid | Revlimid | other | |

| Q42005 | 149 | 106 | 3 | 40 |

| Q12006 | 182 | 107 | 32 | 43 |

| Q22006 | 197 | 107 | 63 | 6 |

Obviously, growth for CELG has been driven by Revlimid. In addition to sales in MDS, Revlimid has been cannibalizing Thalomid sales in Multiple Myeloma. Since CELG pays 1% in royalties for Revlimid compared to 10% for Thalomid, the cannibalization is actually boosting the profit margins of CELG. Another concern is the RevAssist program. Since Revlimid is a new product, the company is providing free samples to new patients and patients that have received this product during a clinical trial. According to the management, this represents 20-25% of the prescriptions. This may be a short term concern for revenues but in the long term it will allow more patients to try Revlimid and become paying customers. This practice is very common in the pharmaceutical industry. During the conference call, the management expects this percentage to drop closer to the industry average of 3-5%.

In addition, last quarter saw a decline in Alkeran. In the conference call, the management addressed this as issues with reimbursement and in manufacturing. They think the sales for Alkeran will recover but they want to be conservative about it.

Stock movement

After a seemingly unstoppable run that started last year and saw the stock price more than double, CELG has been off of it's all time high of about $49 back in July to as low as $41. Part of this is attributable to inflation and recession fears in the market. This profit taking is normal and has coincided with the summer months that historically see low volumes and high volatility.

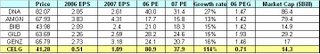

At $41 it is trading at about 80X 2006 earnings (0.51/share estimated) and 38X 2007 earnings (1.09/share estimated). This transaltes to a PEG of about 0.7 (using current PE of 80). To put this in perspective, I have made a table of the same data for other large cap biotech stocks:

Click on the image to enlarge.

These data suggest that CELG is the most expensive stock in that group according to 80 PE but has the highest growth rate at 114%. In fact, if you combine the PE and growth rates in form of PEG, it has the best value with a PEG of 0.71 in this group.

Other factors to consider

CELG is applying for approval of Revlimid in Europe. if approved, this should add significantly to the expected revenues and earnings. The cost of this expansion into europe is already priced in because the company has announced the costs of regulatory filings and has already put into place sales and distribution channels.

In addition, Revlimid is in clinical trials for treating Chronic Lymphocytic Leukemia(CLL) and aggressive non-Hodgkin's lymphomas (NHL) as well as non-deletion 5Q MDS. These, if successful, can add significant revenues in the coming years.

Bottom line:

CELG enjoys a monopoly in blood related cancers with its successful pipeline of IMiDs. Cannibalization of Thalomid by Revlimid is actually good for CELG as it causes profit margin expansion. Additional approvals in Europe and in other diseases would add significant upside potential to current estimates. Downside risks include changes in reimbursement from government or insurers as well as if Revlimid does not get necessary approvals in above mentioned trials. In the long term, CELG has some interesting small molecule kinase inhibitors and other immunomodulators that could allow it to expand into other therapeutic areas including other immune related diseases such as Psoriasis.

As far as trading CELG. I am waiting for the stock price to reach the 200 MVA which is currently around $37. This does not necessarily mean that I am waiting for the stock to drop. The stock could remain above $40 while the MVA moves up over time. I think the third quarter earnings will not be as disappointing as the last one. At $49 CELG's valuation was getting ahead of its earning. But a good Q3 and announcements regarding EU approval and clinical trial developments could send this stock towrds $50 where I think this stock will end up at the end of this year.

Disclosure: As of Sept 13, I own option positions in CELG. They inclue April 2007 $40 call options priced around $7 partially hedged by October$37.5 put options priced around $1. The stock price was around $40.5 when these positions were opened. The goal is to close these positions if CELG moves towards $50 in the near term for a gain of at least %40, or if there is a sharp decline towards $37.5 with a loss of about 10-20%. This will depend on the timing of the move and other outside factors such as volatility.

JMHO

1 comment:

I have closed this position on 10/4/2006 for a 30% profit.

Post a Comment